Leonie Kelly (Director, Head of ESG and Impact Advisory at Ogier Global) moderated this panel with the following speakers:

- John Duong, Founder and CEO of Kind Capital

- Colin Mansell, CEO of Skills Union / GlobalU

- Jessica Rothenberg-Aalami, CEO & Co-Founder of Cell-Ed

- Katy Yung, Managing Partner at Sustainable Finance Initiative

Kicking off the panel, Kelly believes the edtech space is largely unexplored in the impact investment arena. But visionaries have begun to look into the opportunities, given its potential of delivering market rate returns and at the same time transforming an antiquated education system.

Advice for Family Offices and Foundations

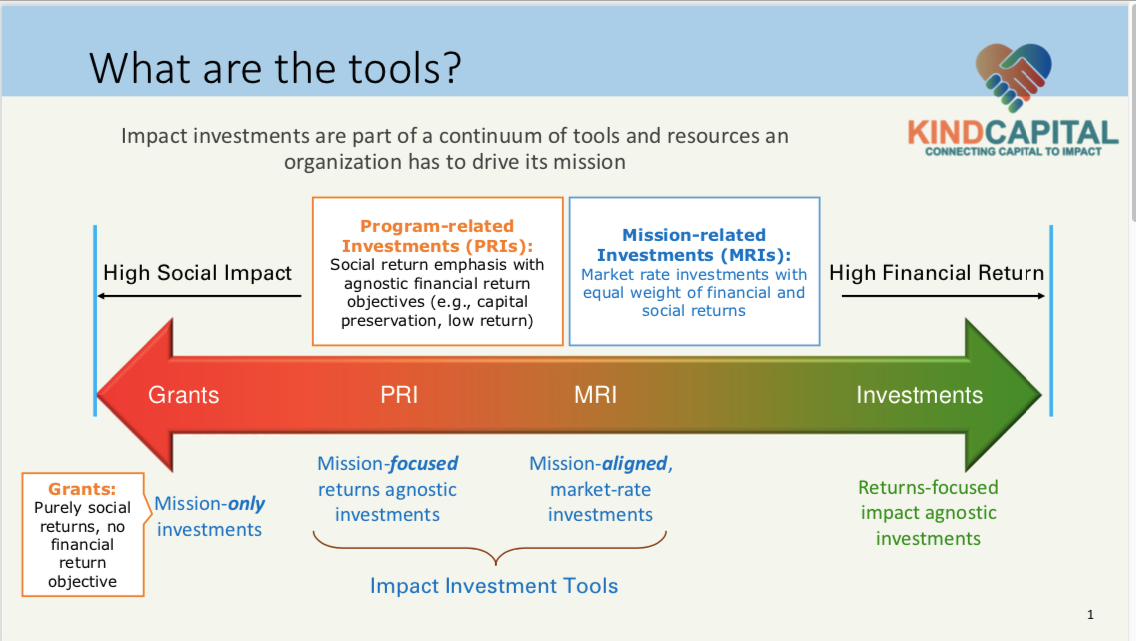

Duong illustrates with the diagram below the continuum of tools that foundations in the US use to support impact organisations, including loans, grants, Programme-related Investments and Mission-related Investments.

Duong points out that impact investment can fulfil a number of objectives:

- Foster market-based, revenue-generating models that can achieve impact at scale

- Catalyze innovation in business models, products and services, financing structures, and more

- Leverage other capital and influence more resources into mission- aligned activities

- Drive capital to entrepreneurs, fund managers, and communities that have been overlooked and under-invested in due to structural and systemic barriers

He quotes three examples to illustrate how impact investment tools are used:

- Kellogg Foundation supports the Mission Good Food Fund to improve access to healthy food with capital staging of loans, grants and MRIs

- UNICEF Innovation Fund provides grants to support for profit edtech startup to develop open source solutions

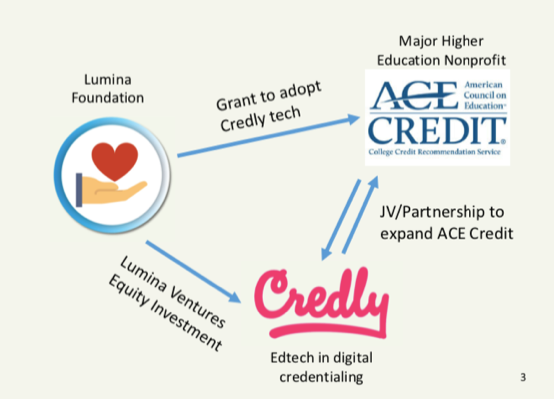

- Lumina Foundation supports a non-profit higher education institute and an edtech startup developing digital credentialing in a JV partnership, by offering a grant to the former and investing in the latter. (See diagram below)

From an impact perspective, the benefits of investment can outweigh conventional philanthropy. Scholarships is a case in point, as it offers a very low return on the capital. It will be more impactful to allocate the same amount of resources to invest in scalable edtech solutions that can benefit a lot more people. The potential investment returns can also be recycled to support other education ventures, creating a virtuous cycle of investment and returns.

Advice for Edtech Ventures

Rothenberg-Aalami shares the funding experience of Cell Ed, a mobile based learning platform for markets with limited internet access. Her case shows that an edtech startup needs different kinds of funding in the different stages of development. Research grant is important to facilitate the development of the proof of concept and to demonstrate the product-market-fit. Other sources include prize money and incubator support. Seed investment will come into play after the beta stage.

Mansell underscores the imperative of alignment with the funder. And impact investment should be patient capital. He also points out that education is about investing in people. There could be some new funding tools (e.g. a loan fund structure/income sharing agreement) to enable students to benefit from the learning and repay the tuition later.

The panel highlights the fact that every family office/foundation is different with varying risk profiles and return expectations. Startups have to be fully aware of how different types of capital can meet their objectives. They also have to do their own homework and due diligence (e.g. reference checks) to find out their mission and the strings attached. Reputation risk, for example, is one major concern of this group of investors. Yung believes that it is always better to talk directly to the principles as the investment and philanthropic arms of these organisations tend to be very separate.

Situation in Hong Kong

Yung shares with the panel that Sustainable Finance Initiative (SFI) has been working with some 20 family offices in Hong Kong and Singapore that are committed to sustainable and impact investment. An earlier survey shows that :

- 45% of the respondents listed education, health and climate change as the areas that they would like to contribute to

- 85% see impact investment as an alternative to philanthropic giving

Yung shares some examples in Asia. One is a Pay-for-Success pilot to enable Oxfam Hong Kong to support non–Chinese speaking kindergarten students in learning Chinese. Another one is the Series C round funding of an Indonesian online learning startup Ruangguru. She adds that their members are still at the learning/exploratory stage, looking into the investments on a deal by deal basis. There is certainly room to look into some new investment tools such as revenue-based financing and social impact bonds. She echoes Duong’s point about the impact of investment vs philanthropy, and sees the need to come up with a vetting tool kit to help impact investors to balance their impact and financial considerations.

John underscores the importance of having a clear objective, which will guide the use of different investment vehicles to match the needs of the investee at the different stages of development. It can start with giving grants and/or loans first and eventually leads to investment that seeks to generate market rate returns. The objective will also determine the metrics of success in terms of how the learning outcome could be measured.

For 2021, SFI would like to encourage impact investors to take a more systemic and holistic approach (i.e. one pocket/total portfolio investing) to enhance capital efficiency. She encourages family offices and foundations to start experimenting with this new approach as the best learning is through doing and start making a few investments .